|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Home Refinance Rates in California: What You Need to KnowRefinancing your home in California can be a smart financial move, especially with the current market rates. However, understanding the intricacies is essential to make the most of your refinancing process. Understanding Refinance RatesHome refinance rates in California fluctuate based on various factors. Keeping an eye on these rates can help you decide the best time to refinance. Factors Influencing Refinance Rates

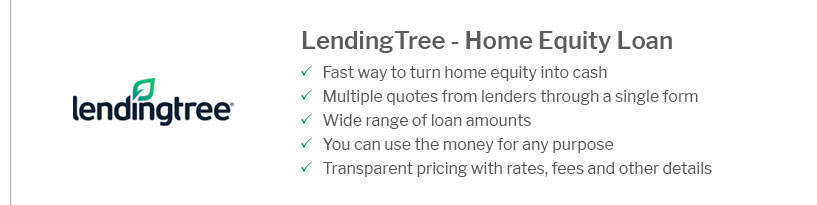

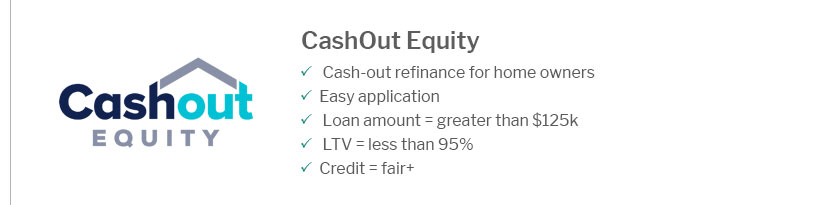

For those interested in a mortgage refinance with no origination fee, it's crucial to evaluate the total cost savings. Types of Refinance OptionsChoosing the right refinance option can significantly impact your financial outcome. Here are some common types: Rate and Term RefinanceThis is the most common refinance option, allowing you to change your loan's interest rate, term, or both, to better suit your financial needs. Cash-Out RefinanceBy choosing a cash-out refinance, homeowners can tap into their home's equity, providing extra cash for other expenses. Comparing different options, such as no points refinance mortgage rates, can help determine the best choice for your situation. Common Mistakes to Avoid

FAQWhat is the best time to refinance my home in California?The best time to refinance is when you can secure a lower interest rate than your current loan or when you need to adjust your loan term to better suit your financial goals. How does my credit score affect refinance rates?Your credit score is a major factor in determining your refinance rate. A higher score typically results in lower interest rates, which can save you money over the life of the loan. https://www.alpinebanker.com/mortgage-rates-ca

Current Mortgage and Refinance Rates in California ; 30 Year Fixed Conv, 6.500%, 6.618% ; 20 Year Fixed Conv, 6.250%, 6.407% ; 15 Year Fixed Conv, 5.625%, 5.820% ... https://www.calhfa.ca.gov/apps/rates/

Lenders can still reserve loans or extend existing rate locks on any loan program with an N/A. CalHFA Conventional First Mortgage Loan Programs. Standard Rate ... https://www.redfin.com/todays-mortgage-rates/california

On Sunday, January 19, 2025, the average APR in California for a 30-year fixed-rate mortgage is 7.001%, a decrease of 6 basis points from a week ago. Meanwhile, ...

|

|---|